📊 AI Report – 2026-01-18

Netflix shows bearish sentiment (69.41%, gap 14.45%). No fresh news available.

Netflix shows bearish sentiment (69.41%, gap 14.45%). No fresh news available.

Airbnb shows bearish sentiment (63.88%, gap 14.94%). No fresh news available.

Welltower shows bullish sentiment (74.54%, gap 4.07%).Quick analysys inside the report

GoDaddy shows bullish sentiment (69.82%, gap 12.07%).Quick analysys inside the report

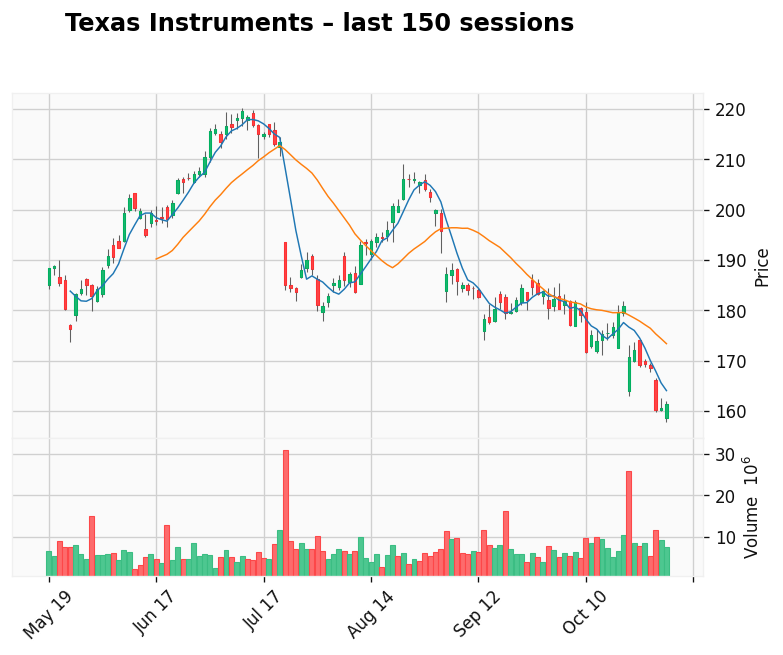

Texas Instruments shows bullish sentiment (60.57%, gap 8.65%). No fresh news available.

Silver and KGHM - it is over?

Allstate shows bearish sentiment (66.20%, gap 2.44%). Quick snapchat what is going on in short report

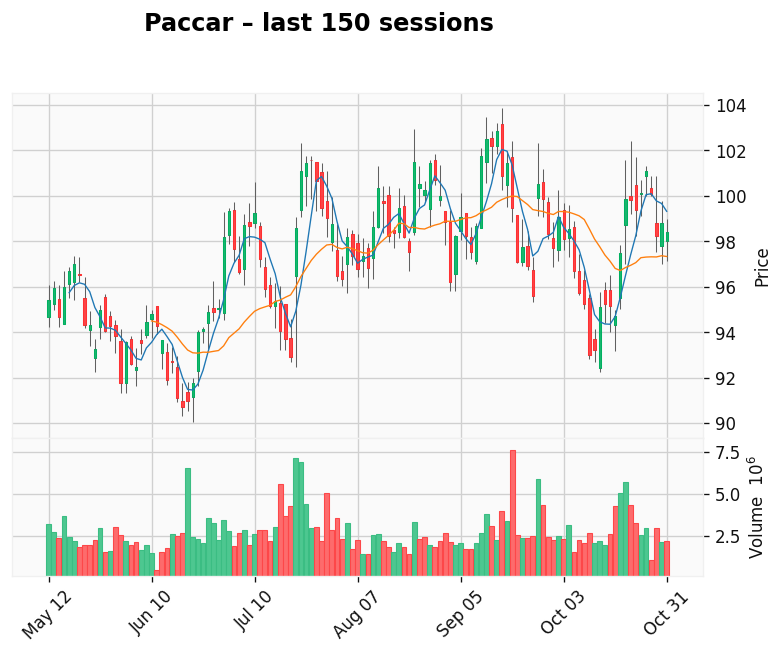

Paccar shows bearish sentiment (68.25%, gap 13.82%). No fresh news available.

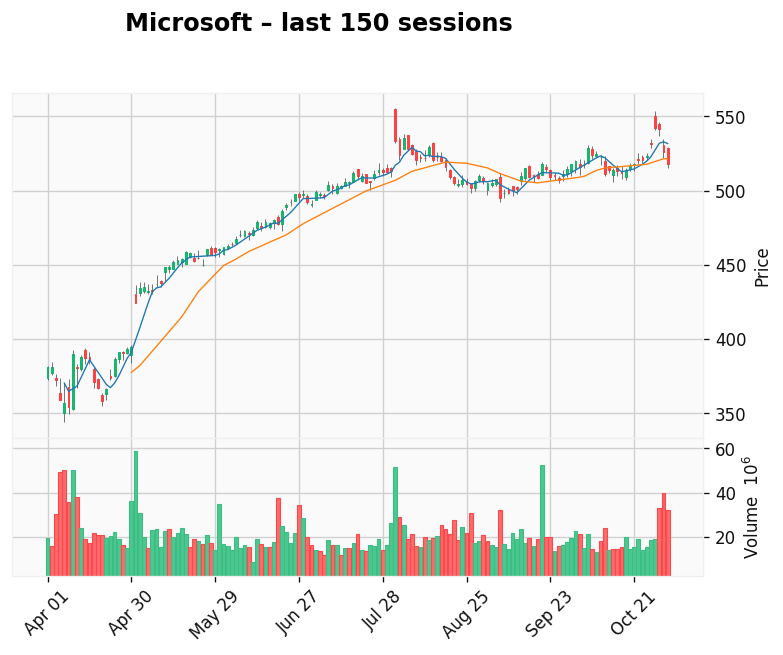

AI CENTERS ARE TOO EXPENSIVE AND WOULD NOT GIVE ANY SINGLE RETURN FOR MEGA CAPS.

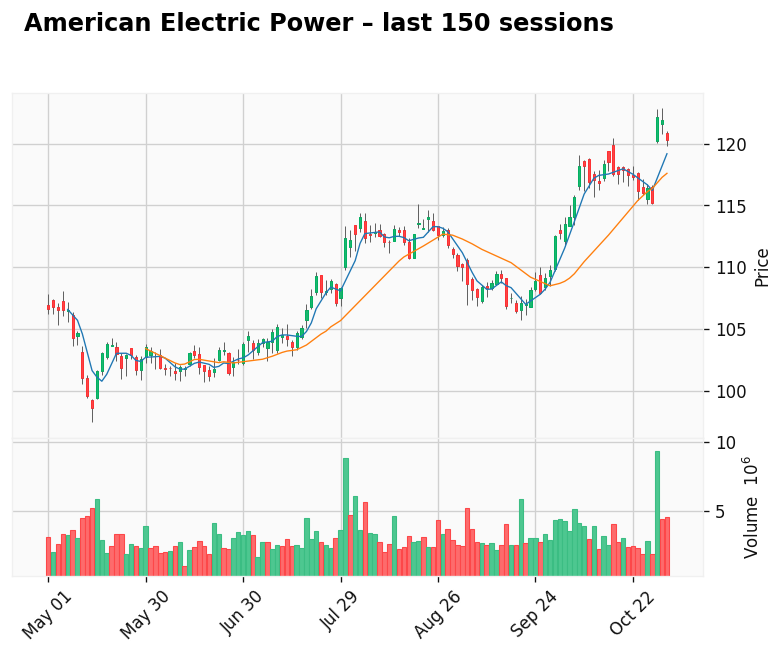

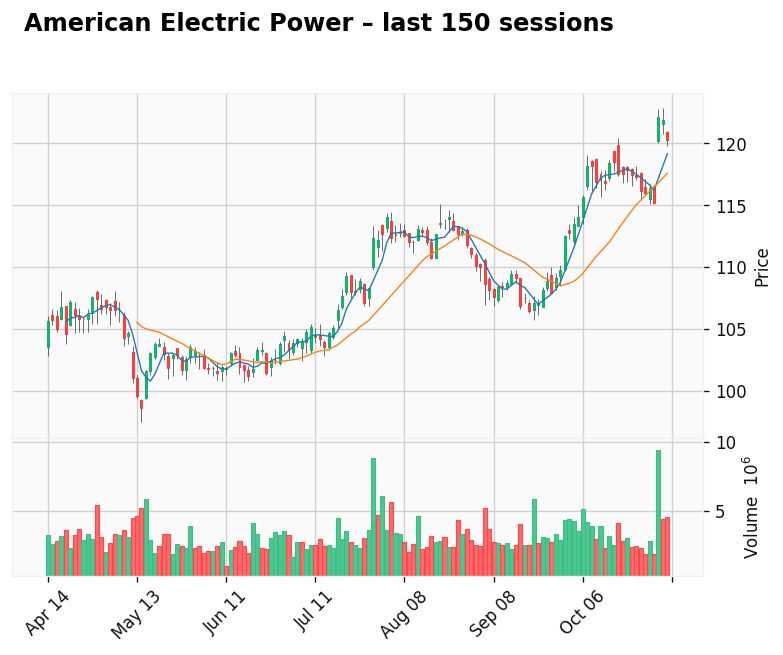

American Electric Power shows bearish sentiment (69.22%, gap 2.53%). No fresh news available.

We think that Banks will not repeat 2024 and 2025 eaenings in 2026. Check it out in our short report

Dino, LPP, CCC Shows neutral sentiment but can gain or lose from falling inflation? (57.37%, gap 34.71%).

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.

AI-generated market summary.