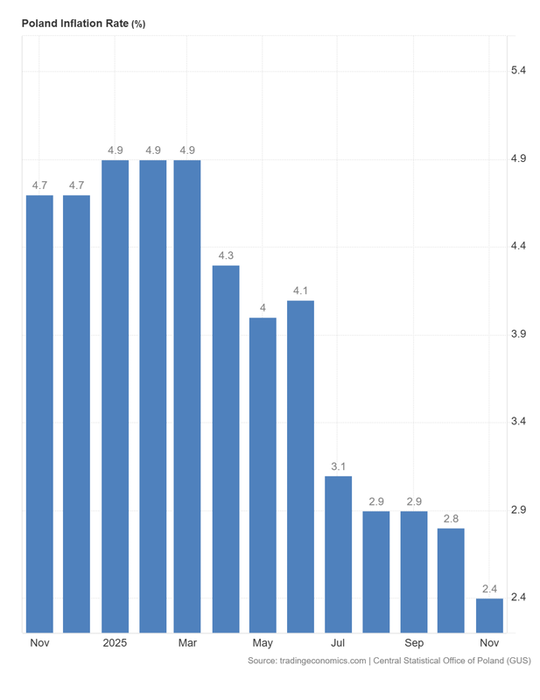

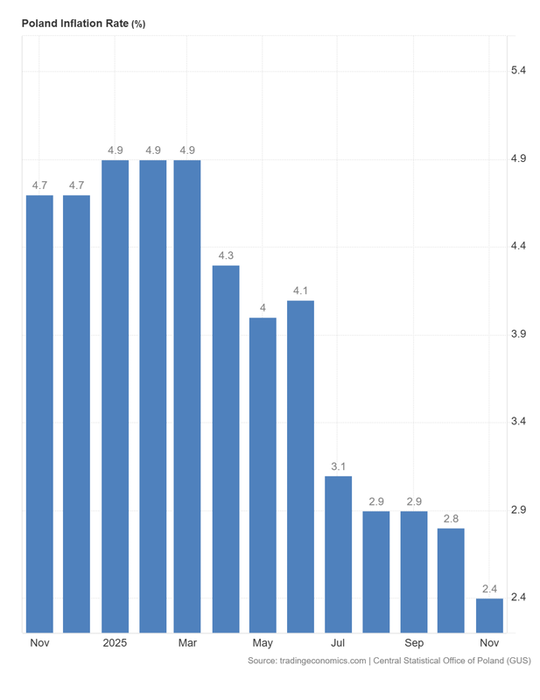

Polish Inflation Trend

The chart below shows monthly CPI inflation based on National Bank of Poland data. After a prolonged double-digit spike, inflation now normalizes toward target:

Source: NBP / Statistics Poland

AI-generated analysis combining technical predictive modeling and macroeconomic trends.

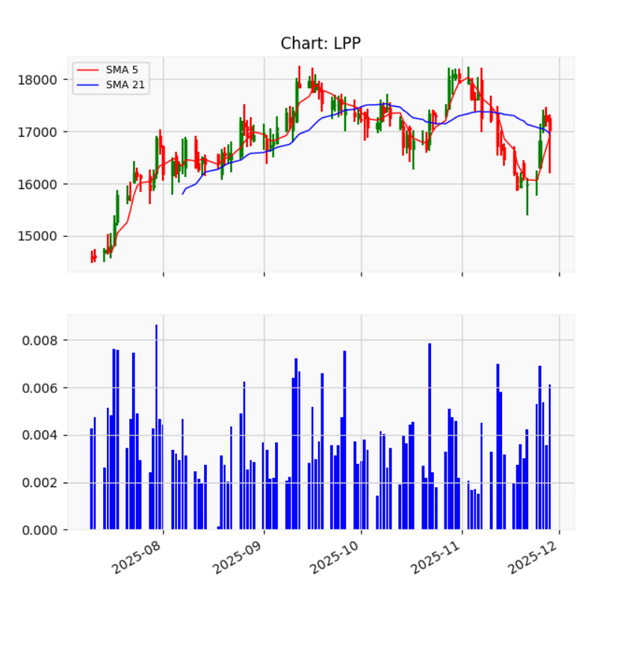

Foxorox AI currently detects a bearish sentiment shift in Polish retail stocks — including LPP and Dino. Meanwhile, inflation in Poland has fallen to 2.4%, the lowest level in nearly three years.

While declining inflation improves real purchasing power, it simultaneously removes inflation-driven revenue expansion, forcing investors to differentiate between real growth and nominal price effects.

The chart below shows monthly CPI inflation based on National Bank of Poland data. After a prolonged double-digit spike, inflation now normalizes toward target:

Source: NBP / Statistics Poland

This explains why the AI model shows higher probability of a short-term pullback, despite positive macro headlines.

A strong, well-positioned fashion retailer with growing international exposure. However, the company is becoming increasingly dependent on real unit demand rather than price-driven expansion. While operational discipline remains solid, slowing wage growth in Poland may soften discretionary spending momentum, resulting in a more modest revenue trajectory.

A resilient grocery chain that continues to benefit from necessity-based retail, yet the diminishing inflation boost introduces a more normalized pace of sales growth. Dino’s strategy of expanding into smaller towns and villages may carry higher operational costs, especially in Eastern Poland, where competitors such as Biedronka and Stokrotka maintain stronger market penetration.

A discretionary footwear retailer exposed to demand volatility and pricing pressure. Leverage remains elevated, but lower inflation and potential interest rate cuts may provide relief on refinancing costs. Still, the broader bearish sentiment around retail could extend downward pressure, especially after the stock’s decline from nearly PLN 240 earlier this year to lows near PLN 130 in December.

| Company | Business Model | P/E | P/BV | Inflation Sensitivity | Live Chart | Commentary |

|---|---|---|---|---|---|---|

| LPP | Fashion retail omnichannel | ~23.4 | ~4.8 | High |

|

Margins depend on inventory turnover and markdown control. |

| Dino | Value grocery retail | ~27.9 | ~7.2 | Medium |

|

Growth normalizes as inflation tailwind fades. |

| CCC | Footwear retail | ~18.6 | ~1.9 | High |

|

High debt remains a risk, but falling interest rates may materially improve refinancing conditions. |

Dino — Bearish Probability: 57.37% (Gap: 34.71%)

LPP — Bearish Probability: 54.95% (Gap: 9.43%)