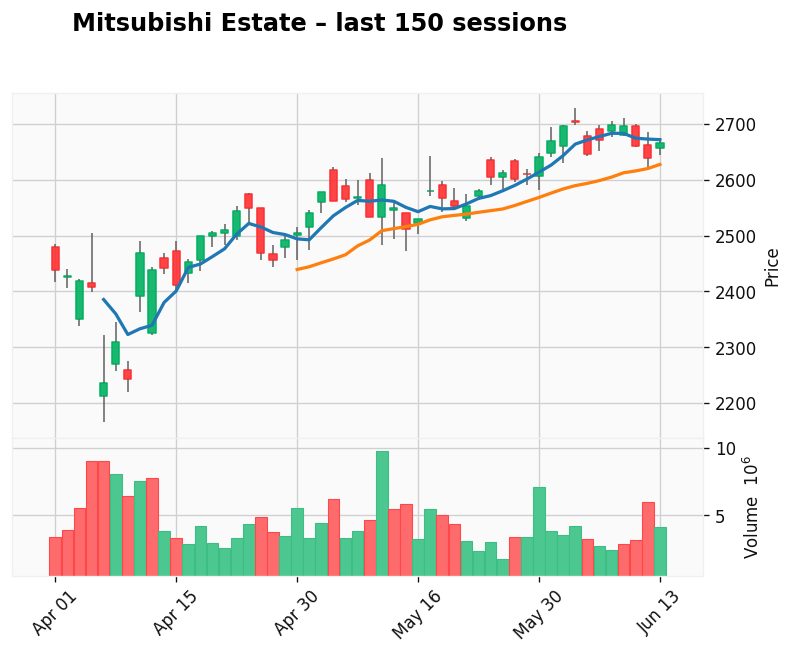

Mitsubishi Estate

Gap: 11.56% Candle: 65.49% (black)

Mitsubishi Estate shows bearish sentiment (65.49%, gap 11.56%). Mitsubishi Estate – Navigating Rising Costs and a Slowing Real-Estate Cycle Mitsubishi Estate, Japan’s leading urban developer and manager of premium commercial real-estate assets in the Marunouchi district of Tokyo, has started to attract heightened caution from investors. While the company remains structurally strong, several emerging headwinds are clustering in ways that risk denting sentiment. Firstly, the firm reported a roughly 9.4% revenue miss in its latest quarterly disclosure, suggesting that underlying leasing and development momentum is weakening. Simply Wall St This shortfall has challenged market expectations especially given Mitsubishi Estate’s positioning as a high-end landlord in Tokyo’s office sector. Secondly, Mitsubishi Estate’s balance sheet is under pressure from elevated debt and the broader Japanese real-estate backdrop. According to one screening, the company carries a debt-to-equity ratio of about 138 %, and a long-term debt/equity of ~119 %, metrics that are noticeably high for the sector. Reuters Such leverage amplifies risks when rental growth and occupancy begin to soften. At the same time, Japan’s real margin of safety in property development is shrinking. With interest rates trending upwards, property valuations are coming under scrutiny. Activist attention is also turning toward real-estate companies with extensive non-core assets. As one Financial Times piece observed, Mitsubishi Estate’s large property holdings make it vulnerable to calls for value unlocking. Financial Times Moreover, Mitsubishi Estate is pursuing aggressive overseas collaborations (for example, in Australia and elsewhere) in order to diversify. While diversification is strategic, it also introduces execution risk, foreign-currency exposure, and capital deployment pressure—all factors that may weigh on near-term returns. The Australian +1 From a sentiment standpoint, what’s clear is that although the business remains well positioned for the long term, the market is shifting from “optimistic growth ahead” to “how near term risks play out.” The combination of a revenue miss, high debt metrics, and slowing leasing growth in its core Tokyo market means the stock is now trading more on risk than on upside. In essence: Mitsubishi Estate’s fundamentals are not broken—its assets and brand remain top-tier—but the trajectory of earnings growth has decelerated, capital cost risk has increased, and margin expansion appears more distant than many had assumed. For investors who have priced in flawless execution, this recalibration means the company may need time to validate its strategy before sentiment recovers.