Troubles in the Trucking Giant: What’s Really Going On at PACCAR?

PACCAR, the company behind Kenworth, Peterbilt and DAF, is still printing solid profits, but the numbers from its latest reports show a business clearly coming off the peak of the last truck cycle. After a record 2023, 2024 full-year revenues slipped to about $33.7 billion from $35.1 billion and net income eased to roughly $4.2 billion from $4.6 billion, with return on equity falling from the mid-30s to the mid-20s. The first nine months of 2025 brought a further cooldown: net sales and financial services revenues dropped to around $21.6 billion versus more than $25.7 billion a year earlier, while reported net income was $1.8 billion and adjusted net income about $2.1 billion once a large civil-litigation charge in Europe is stripped out...

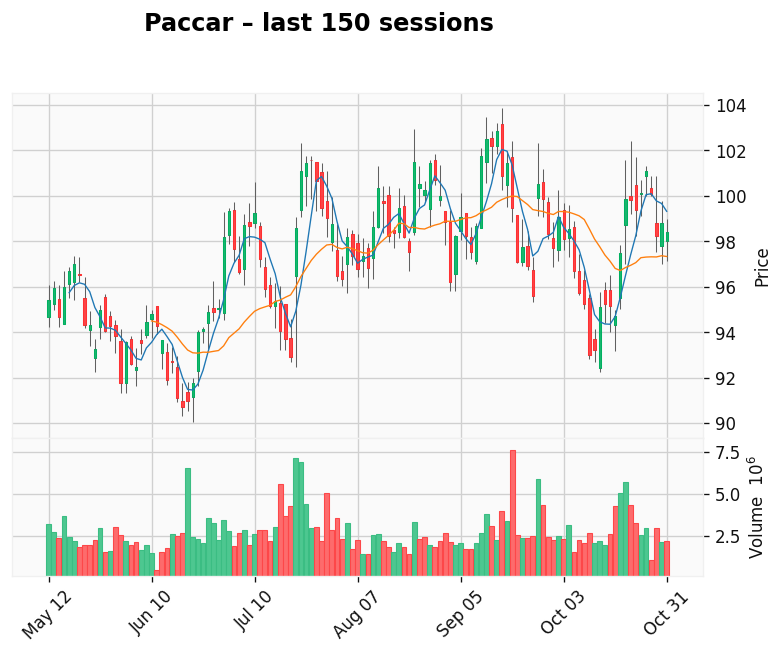

The quarterly pattern tells the same story. In Q1 2025 PACCAR generated about $7.4 billion of revenue and just over $500 million of net income, down from roughly $8.7 billion and $1.2 billion in the prior-year quarter. Q2 2025 came in at $7.5 billion of revenue and about $724 million of net income, again below 2024 levels. Q3 2025 saw revenues fall to $6.7 billion from $8.2 billion a year earlier, with net income sliding from roughly $972 million to $590 million, even as truck deliveries remained strong at almost 32,000 units and PACCAR Parts posted record quarterly revenue of around $1.7 billion. Parts and Financial Services are cushioning the downturn, but the truck business is clearly normalizing from the 2023–2024 boom...

On the balance-sheet and valuation side, PACCAR still looks like one of the higher-quality names in global trucks. Its 2024 return on beginning equity was in the mid-20% range, supported by an asset-light truck model and a profitable captive finance arm with more than $22 billion of assets. Leverage at the consolidated level is moderate, with debt-to-equity around 0.9×, largely tied to the Financial Services portfolio rather than the industrial business. In the market, the stock currently trades on a price-to-earnings multiple a little above 20× and offers roughly a 1–1.5% dividend yield from its regular quarterly payout, occasionally topped up by special dividends. That combination — high ROE and a premium P/E — tells you investors still view PACCAR as a quality compounder, not a deep-value cyclical...

The backdrop, however, has turned tougher for the entire heavy-truck universe. Daimler Truck, the global volume leader, saw 2024 unit sales fall about 12% and group revenue dip to roughly €54 billion, with adjusted industrial margins slipping from just under 10% to the high-8% range and a multi-year cost-cutting plan now underway in Europe. Volkswagen’s truck arm Traton reported 2024 sales revenue of about €47.5 billion and an adjusted operating margin a bit above 9%, but is also guiding for a much softer truck market in 2025 and has started cutting production at some plants as demand cools. Across Europe and North America, order books are normalizing after the post-pandemic surge, while new emissions rules, electrification spending and tariff noise are pushing costs higher and making planning harder for fleets and OEMs alike...

PACCAR’s own commentary acknowledges those pressures. Management is dealing with a sizeable non-recurring legal charge in Europe, navigating new U.S. Section 232 truck tariffs and preparing for lower-margin electric and low-emission products — all while trying to hold pricing and protect profitability. The company’s response is to lean into its strengths: premium brands, high-margin aftermarket parts, a disciplined finance arm and ongoing capex and R&D in cleaner powertrains, connected services and AI-driven uptime tools. Fundamentally, PACCAR is not a broken story — but it is in the difficult part of the cycle, where revenue growth is slowing, margins are under pressure, and investors are being asked to pay a quality multiple for earnings that may be past their peak. Whether that premium holds will depend on how well PACCAR can manage the downcycle, execute on cost and technology investments, and keep outgrowing peers like Daimler Truck and Traton on returns, not just volumes...