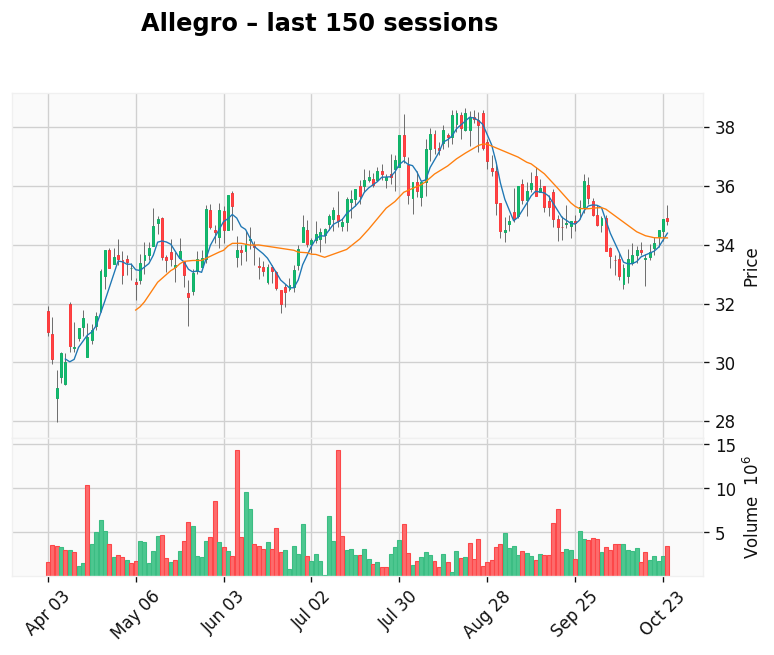

Allegro

Gap: 6.17% Candle: 67.47% (white)

Allegro shows bullish sentiment (67.47%, gap 6.17%).Allegro.eu S.A., Poland’s leading e-commerce platform, has recently been in the spotlight with a mix of growth updates, strategic moves, and regulatory challenges. In its first-quarter 2025 report, the company announced that gross merchandise value (GMV) rose by 8.9% year-over-year, while the number of active buyers surpassed 21 million. Management reaffirmed full-year guidance, signaling confidence in the platform’s steady expansion despite a maturing domestic market. Still, analysts note that growth momentum has slowed compared to previous years, suggesting that Allegro’s core Polish market may be nearing saturation. A significant development came when Poland’s consumer watchdog, UOKiK, launched proceedings against Allegro—alongside InPost, DHL, and DPD—over alleged “greenwashing.” The authority claims the companies misled consumers with exaggerated claims about the environmental friendliness of their logistics and packaging operations. The case could carry financial penalties and reputational risks at a time when sustainability is central to Allegro’s brand identity. Strategically, Allegro continues to strengthen its regional presence in Central and Eastern Europe, expanding operations into Hungary and Slovakia. As part of this effort, the company is cutting back on ultra-long delivery imports from Asia to focus on faster, locally sourced fulfillment — a move that aligns with its strategy to improve customer satisfaction and delivery reliability, even if it reduces the assortment of ultra-cheap items. Investor sentiment was also influenced by a mid-2025 share sale, when major private equity backers Cinven and Permira offloaded around 55 million shares worth approximately €480 million. While the sale was described as a standard portfolio adjustment, it added short-term pressure to the stock and sparked discussions about the long-term confidence of institutional investors. Despite these headwinds, Allegro may see a short-term rebound in performance and sentiment as the Black Week and holiday shopping season approach. Historically, the company has benefited from surging consumer activity during this period, driven by aggressive promotions, expanded logistics capacity, and the continued shift toward online retail. A successful holiday quarter could provide a meaningful boost to both revenue and investor confidence, temporarily offsetting recent regulatory and market concerns. Overall, Allegro remains a resilient leader in Polish e-commerce — navigating slower domestic growth and regulatory scrutiny, yet well positioned to capitalize on seasonal demand and cross-border expansion.