Foxorox AI Market Forecast – 2025-12-04

AI-generated analysis combining predictive modeling and recent market context.

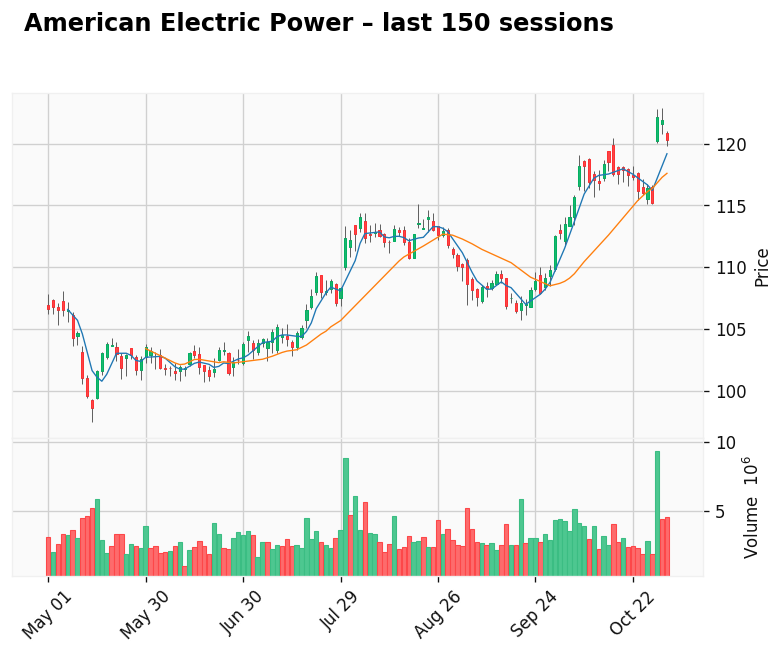

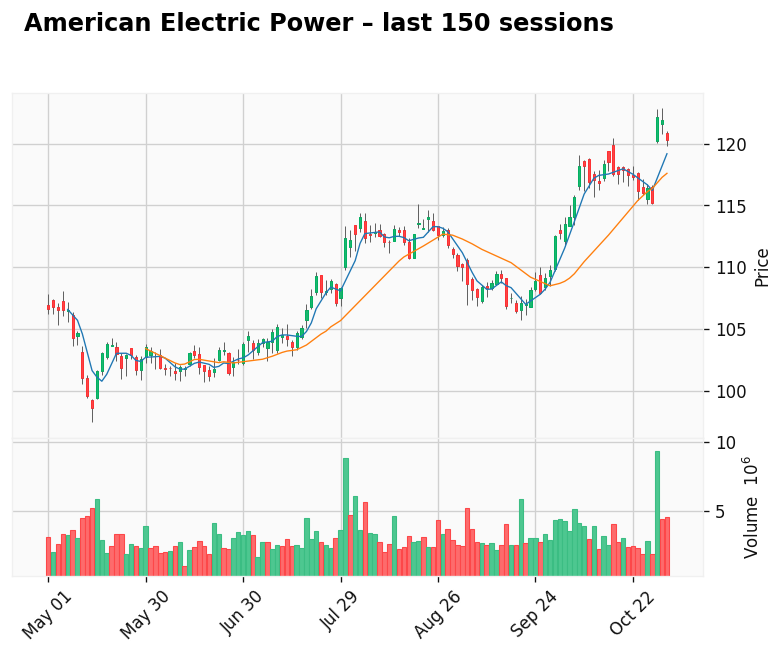

American Electric Power (AEP)

American Electric Power

Gap: 2.53% Candle: 69.22% (black)

American Electric Power shows bearish sentiment (69.22%, gap 2.53%).

American Electric Power – Is the AI Power Boom Really That Bullish?

AI-powered demand for electricity sounds like a dream scenario ...

🇺🇸 AEP – a giant in a “perfect” macro story… at least on paper

The U.S. power sector is going through a structural shift. Data centers, cloud infrastructure and AI workloads...

AEP is big, systemically important and defensive – but that doesn’t automatically make it a pure play...

🔻 1. More demand ≠ unlimited pricing power

AEP is a regulated utility. This means:

- It can’t freely set prices due to regulatory caps

- Tariff increases take long approval cycles

- ROE limits upside profit margin

Even with AI power demand boom — earnings may not scale equally fast.

⚠️ 2. Data center boom as a double-edged sword

Market narrative: “More servers → more energy → utilities win”. Reality is more complex:

- Hyperscale loads require massive grid upgrades

- Capex heavy → returns slow

- AI companies negotiate low long-term prices

- Renewable transition accelerates cost burden

🌪 3. High capex + high rates = valuation drag

Utilities = debt financed. High interest rates erode margin expansion.

🚧 4. Energy transition is expensive

Coal retirement, new solar/wind build-outs, regulatory uncertainty...

🤔 AI demand might be overhyped long-term

- Compute efficiency improves over time

- On-site generation reduces dependency

- PPAs can limit margin expansion

🧠 Final Takeaway

AEP = stable, dividend friendly, defensive — not explosive AI growth play.

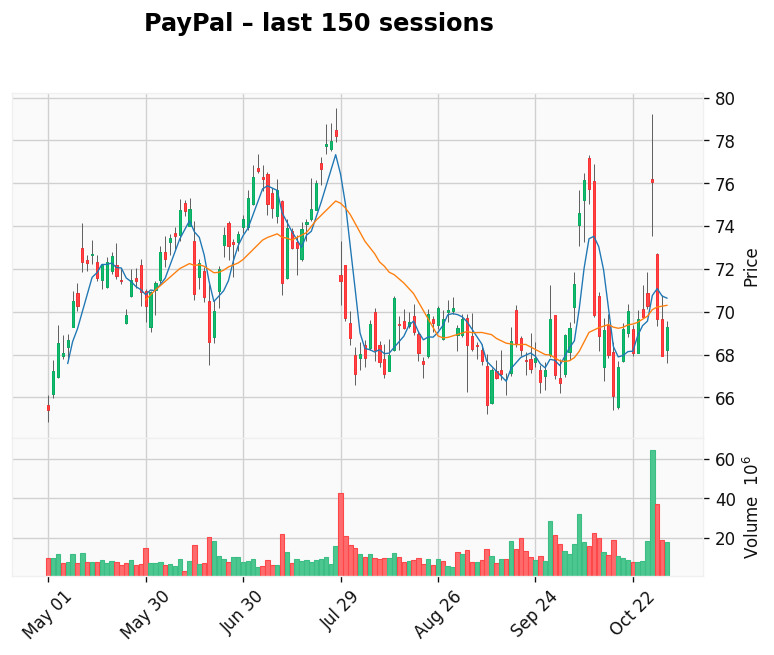

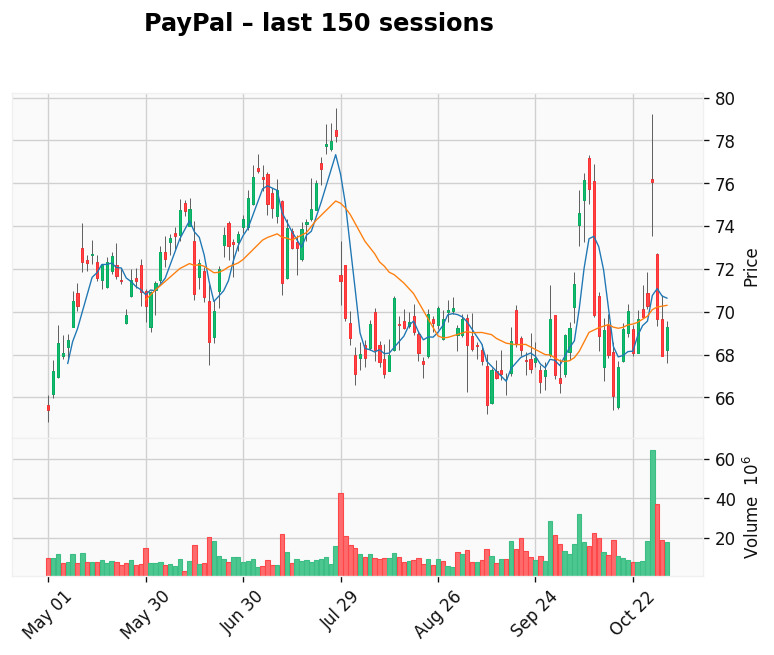

PayPal

Gap: 44.34% Candle: 62.00% (black)

PayPal shows bearish sentiment (62.00%, gap 44.34%).

PayPal – A Former Fintech King Now Fighting for Relevance

PayPal was once the icon of online payments with a dominant brand and near-monopoly visibility.

Today the company’s market cap has dropped from over $300B to around $60–70B. This is not just a post-pandemic correction

but a result of deeper structural issues built into the business model.

PayPal still holds global scale and a massive user base — but it has lost the moat and margin power it once had.

It is now one of many players in a brutally competitive payment ecosystem.

⚠ 1. Competition is everywhere — and stronger than ever

PayPal’s core challenge is simple: it is no longer unique. Competitors are attacking from all sides:

- Apple Pay / Google Pay dominate mobile payments

- Stripe controls the developer + e-commerce integration space

- Klarna, Affirm, BNPL players captured younger users

- Bank-to-bank payments reduce the need for intermediaries

- Stablecoins/Web3 rails threaten cross-border fees

The result? Take-rate pressure and thinning margins.

⚠ 2. Volume grows — profit per transaction shrinks

Revenue per transaction continues to decline even as payment volume increases.

PayPal has become a scale processor rather than a premium platform with pricing power.

Growth in GMV ≠ growth in EPS.

⚠ 3. Venmo: huge user love — tiny monetization

Venmo remains culturally iconic — but monetization is weak relative to scale.

A beloved consumer product is not yet a high-margin business.

🔥 Great engagement — 🧊 Weak ARPU.

⚠ 4. AI does not fix PayPal’s core business problem

AI helps PayPal with fraud detection, risk scoring and automation —

but AI is not a revenue engine here, only an efficiency tool.

For Nvidia AI is revenue — for PayPal AI is cost optimization.

⚠ 5. No structural tolling moat like VISA / Mastercard

Visa & Mastercard earn a fee on every card transaction globally.

PayPal earns only when merchants choose it.

A network toll vs a competitive payment option — very different economics.

🧠 Investor Takeaways

- PayPal is in transition — from hyper-growth to value/turnaround narrative.

- Still a strong brand with global reach — but moat is weaker each year.

- Returns depend heavily on improving take-rate and monetizing Venmo.

- Upside exists only if PayPal rebuilds pricing power or launches sticky new services.

PayPal is not dying — but no longer a fintech rocket.

It fits turnaround/value strategies rather than high-growth expectations.