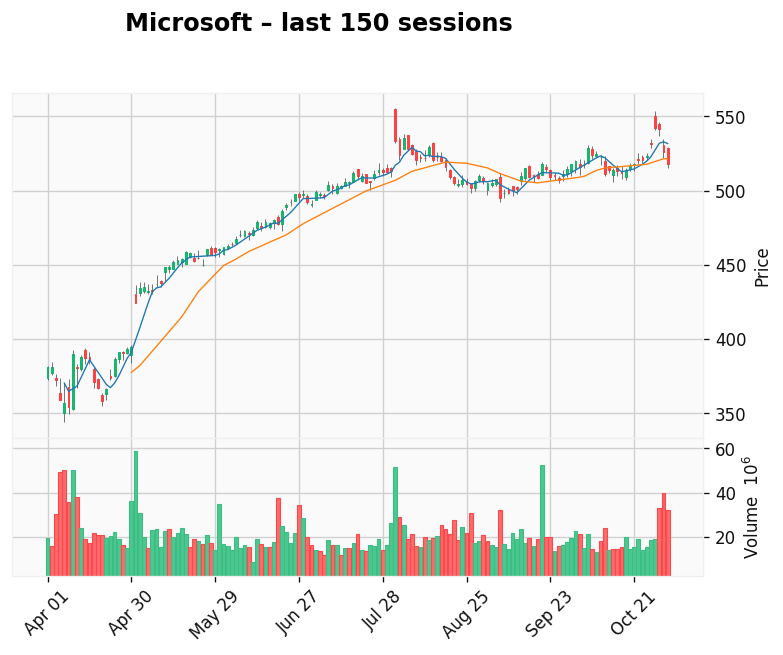

📉 Microsoft

Gap: 5.85% | Candle: 72.98% (black)

Microsoft shows bearish sentiment (72.98%, gap 5.85%).

Microsoft’s market sentiment has turned cautious, not because of a fundamental breakdown, but due to growing tension between its impressive AI-driven growth and the near-term financial and regulatory headwinds that accompany it.

The company’s latest quarterly results were strong — revenue and earnings once again exceeded expectations, and Azure cloud growth remained robust around 40%. Yet, the market’s reaction was subdued. Investors focused on management’s guidance that capital expenditures will rise further in fiscal 2026 as Microsoft expands its AI infrastructure. This means heavier spending on data centers and chips — great for long-term positioning but compressing near-term free cash flow and operating margins.

At the same time, Microsoft faces persistent regulatory friction. In Europe, it agreed to unbundle Teams from its Office 365 suite to ease antitrust pressure, while in the United States, authorities continue to examine its deep partnership with OpenAI. These developments don’t derail Microsoft’s strategy, but they inject uncertainty and headline risk, making investors more cautious.

Inside the company, ongoing restructuring — including workforce adjustments at Xbox, Activision Blizzard, and LinkedIn — reflects a focus on redirecting resources toward AI and cloud but also highlights integration challenges. Microsoft is scaling AI products, consolidating acquisitions, and defending its competitive edge — a balancing act that adds execution risk.

From a sentiment perspective, part of the current weakness is psychological. After years of outperformance, Microsoft’s valuation is priced for perfection. Any result that is “good” rather than “spectacular” now triggers selling pressure. With the AI narrative intact but expectations sky-high, the market is shifting from euphoria to realism.

Ultimately, Microsoft’s story remains one of leadership and innovation — but the near-term outlook is dominated by the cost of ambition. As AI investments rise faster than immediate returns, investors are adjusting to slower profit growth. The fundamentals are strong, but sentiment signals a pause after an extraordinary rally.