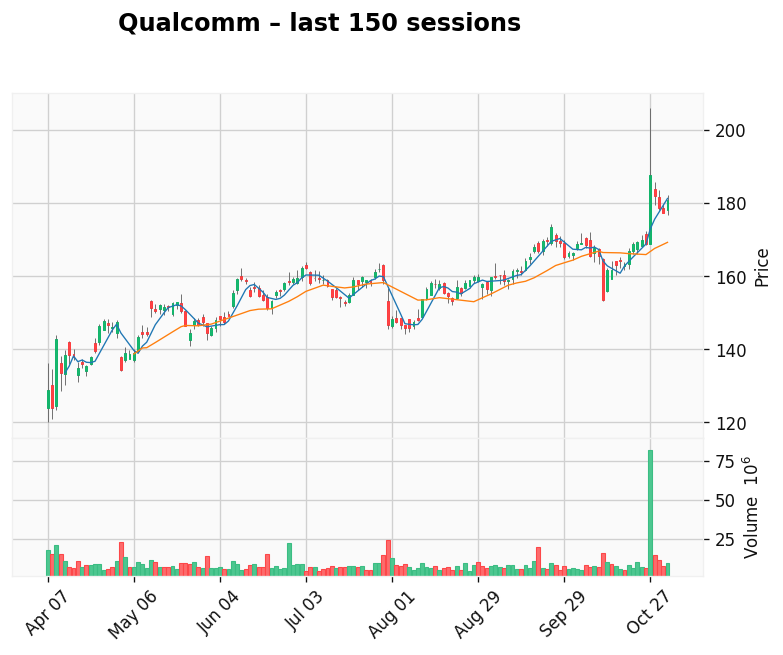

Qualcomm

Gap: 38.27% Candle: 71.45% (black)

Qualcomm shows bearish sentiment (71.45%, gap 38.27%). Qualcomm – Regulatory and Market Risks Cloud Near-Term Outlook Qualcomm’s market sentiment has turned cautious as investors digest a series of regulatory and operational challenges that threaten to overshadow the company’s recent gains in AI and mobile chip segments. While the semiconductor giant remains one of the key enablers of 5G and AI-enabled smartphones, mounting headwinds in China and regulatory uncertainty are weighing on confidence. The company recently admitted that it completed its acquisition of the Israeli automotive chipmaker Autotalks without notifying Chinese antitrust authorities, prompting an official investigation. This misstep has drawn scrutiny in one of Qualcomm’s most important markets, where nearly two-thirds of its handset revenues originate. The timing couldn’t be worse — U.S.-China trade tensions and tech export restrictions already make operations in the region fragile, and an additional probe adds legal and diplomatic risk to the company’s long-term positioning. In Europe, Qualcomm’s legacy legal battles also continue to resurface. The EU Court recently reaffirmed a €238 million fine over historical predatory pricing practices, reminding investors of the company’s persistent exposure to antitrust and regulatory enforcement. Combined with 24 distinct risk factors disclosed in its recent filings — most prominently in the legal and innovation categories — this paints a picture of a company still navigating a complex compliance environment. Operationally, Qualcomm is not immune to the cyclical slowdown in the smartphone sector. While recent quarterly results showed healthy revenue growth, profit margins have been pressured by a large non-cash tax charge and cautious guidance. Moreover, reports of potential licensing tensions with ARM over chip design rights have amplified investor unease about the durability of Qualcomm’s technology ecosystem. Despite these challenges, Qualcomm remains strategically important in the global semiconductor landscape, especially in AI-capable mobile computing and automotive connectivity. However, the short-term narrative has clearly shifted: regulatory exposure, dependence on China, and margin pressure are keeping the stock in check. For now, Qualcomm’s future depends not only on technological leadership but also on its ability to navigate an increasingly politicized and tightly regulated global chip market. #Qualcomm #AITrading #Foxorox #MarketForecast #Semiconductors #StockAnalysis #QCOM