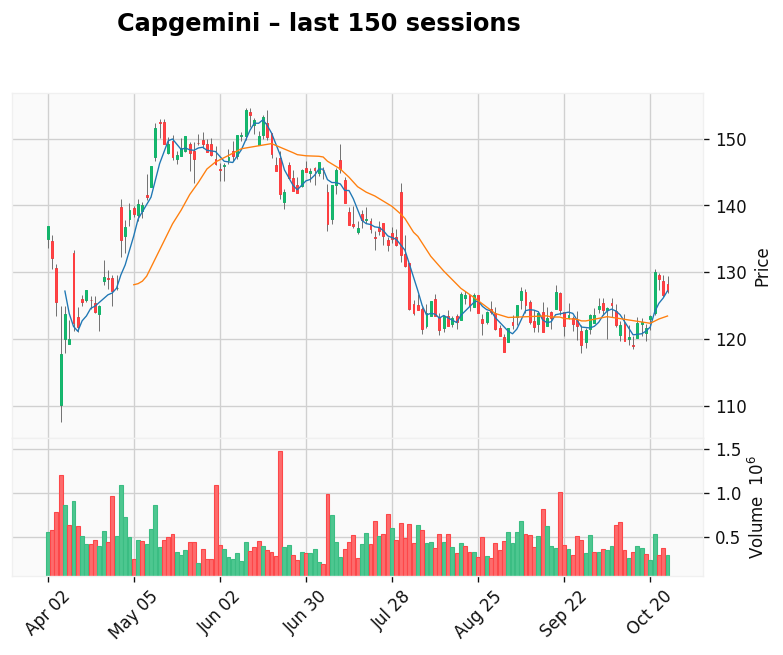

📊 Capgemini

Gap: 37.61% | Candle: 74.93% (black)

Capgemini shows bearish sentiment (74.93%, gap 37.61%).

Why the Stock Is Falling Despite Strong AI Ambitions

Capgemini SE, one of Europe’s largest technology and consulting companies, has faced notable pressure on its stock in recent months. Despite strong positioning in artificial intelligence and digital transformation, investors have reacted cautiously to the company’s recent financial outlook and strategic moves.

⚙️ Slower Growth, Softer Guidance

In February 2025, Capgemini reported results slightly above expectations — but its 2025 revenue forecast projected only a narrow growth range between –2% and +2%. For a market expecting acceleration from AI-driven consulting demand, this was a disappointment. Shares dropped nearly 7.7% in one day, signaling a loss of confidence in short-term growth momentum.

“Investors were expecting Capgemini to ride the AI wave faster — the cautious outlook broke that narrative.”

🧩 Acquisition Pressure: WNS Deal and Integration Risks

In July 2025, Capgemini announced a $3.3 billion acquisition of WNS Global Services, a major player in business process outsourcing (BPO). While the move aims to strengthen Capgemini’s position in data and automation services, the market reaction was negative — the stock fell about 5% following the news.

Investors worry that BPO margins may shrink under the AI automation boom, and that integration costs could slow near-term earnings growth. Still, from a strategic perspective, the deal positions Capgemini strongly in AI-driven back-office transformation.

🧠 Rising Costs and Regulatory Headwinds

In September 2025, U.S. policy changes on H-1B visa fees increased operational costs for IT and consulting firms with large American workforces. Capgemini, which employs thousands in the U.S., is directly affected — the market quickly priced in a potential hit to profit margins.

💡 Market Sentiment vs. Reality

While short-term sentiment is negative, the underlying fundamentals remain sound: diversified global clients, strong AI partnerships (Google Cloud, AWS), and a growing data analytics portfolio. The real challenge is investor patience — markets are seeking fast AI monetization, while Capgemini’s transformation is structural and long-term.

📈 Foxorox Insight

Our AI sentiment model flagged bearish tone and volume divergence around key news dates in February and July 2025. The model suggests oversold conditions in the medium term, with sentiment likely to stabilize as AI project revenues scale in 2026.

🦊 Summary

Capgemini’s decline isn’t about weakness — it’s about expectation mismatch. Investors priced in an AI revolution; management delivered steady, sustainable evolution. As AI integration deepens, Foxorox expects fundamentals to regain investor trust — but patience is required.

#Capgemini #AITrading #MarketForecast #Foxorox #AlgorithmicTrading #MachineLearning #StockAnalysis #EuropeanMarkets